TaxSensePro

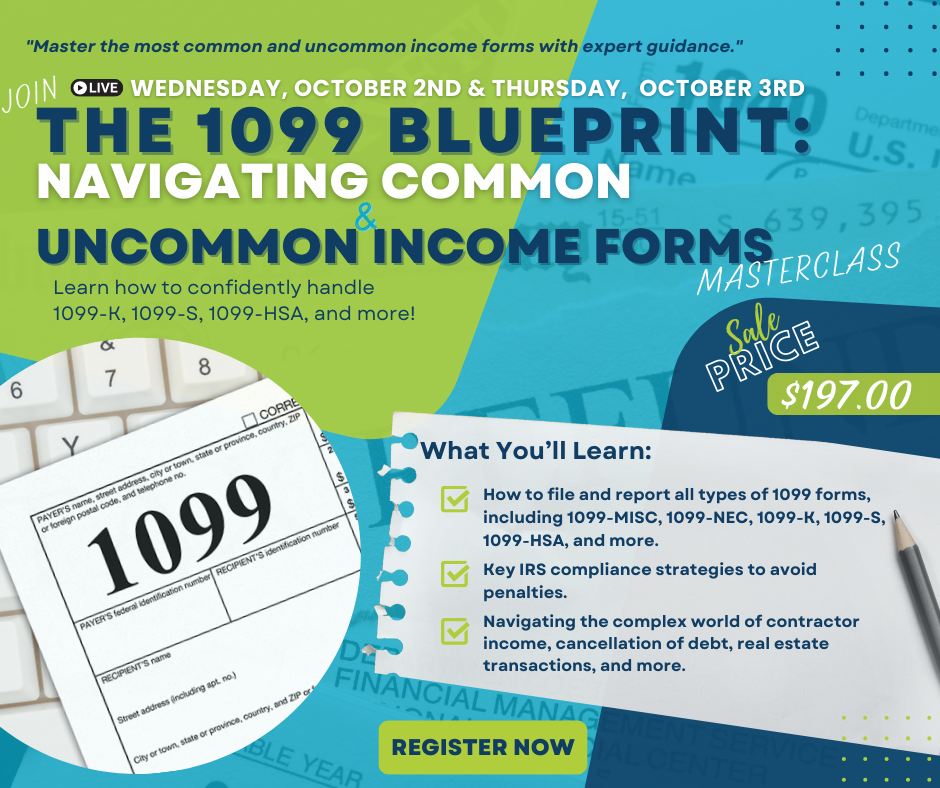

The 1099 Blueprint: Navigating Common and Uncommon Income Forms Masterclass

The 1099 Blueprint: Navigating Common and Uncommon Income Forms Masterclass

Couldn't load pickup availability

Unlock the Secrets to Perfect 1099 Filing!

Are you a tax professional, business owner, or freelancer confused by the wide array of 1099 forms? Look no further! The 1099 Blueprint Masterclass is your ultimate guide to mastering both common and uncommon income forms, including 1099-MISC, 1099-NEC, 1099-K, 1099-S, and 1099-HSA.

In this comprehensive, step-by-step training, you'll learn everything you need to confidently file and report various types of income—helping you stay compliant with IRS regulations and avoid costly penalties.

What You’ll Learn:

- Master Common 1099 Forms: Get clear guidance on 1099-MISC, 1099-NEC, 1099-INT, 1099-DIV, and more.

- Uncommon 1099 Forms Demystified: Dive deep into lesser-known forms like 1099-K (Payment Card and Third-Party Network Transactions), 1099-S (Real Estate Transactions), and 1099-HSA (Health Savings Account Distributions).

- Stay IRS Compliant: Learn how to file accurately, meet deadlines, and avoid penalties with confidence.

- Bonus Resources: Gain access to templates, tracking tools, and checklists to streamline your 1099 filing process.

- Live Q&A: Get real-time answers to your specific questions from expert tax professionals.

Who This Masterclass is For:

- Tax Professionals & Accountants: Sharpen your expertise and serve clients better by mastering the full range of 1099 forms.

- Freelancers & Independent Contractors: Understand how to correctly report income from various sources.

- Small Business Owners: Learn to properly issue 1099s to contractors, vendors, and service providers.

Why Choose The 1099 Blueprint?

✔ Comprehensive Coverage: From 1099-MISC to 1099-K and beyond, we leave no form unexplained.

✔ Easy to Follow: Step-by-step guidance with practical examples and case studies.

✔ Expert Instruction: Learn from experienced tax professionals with real-world knowledge.

✔ Bonus Tools: Access to downloadable templates and checklists to make your filing process easier.

Share